Essential questions to ask when buyingfull-time RV insurance

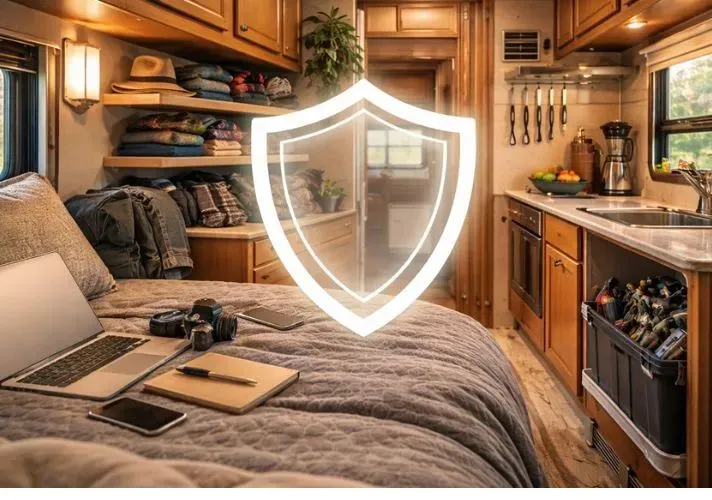

Living full time in an RV means your vehicle is not only transportation but also your permanent home. Every personal belonging, from clothing and electronics to kitchen equipment and documents, travels with you. For this reason, choosing the right full-time-rv-insurance-claims is one of the most important steps in protecting your lifestyle. Standard RV policies are often designed for occasional trips and weekend use, not for permanent living. By asking the right questions before you buy, you can avoid coverage gaps and make sure your policy truly fits the realities of life on the road.

This guide highlights the most important topics to discuss with insurers so you can make informed decisions and secure coverage that offers real peace of mind.

Understanding coverage limits and exclusions

The first thing to clarify is what your policy covers and where its limits lie. Since your RV holds everything you own, ask how much protection is provided for personal belongings such as clothing, electronics, appliances, and tools. Make sure the coverage limit is high enough to replace your items in case of theft, fire, or major damage.

Exclusions are just as important. Some policies may not cover certain risks, including flooding, earthquakes, mold, or long term wear and tear. Knowing exactly what is excluded helps you decide whether additional riders or separate policies are needed.

You should also confirm how the insurer defines full time living. Ask whether the policy officially recognizes you as a permanent resident of the RV and whether it offers coverage similar to a combination of auto and homeowners insurance. This distinction is essential when comparing standard RV plans with true full-time-rv-insurance

Evaluating the claims process

When a loss occurs, a smooth and fast claims process becomes critical. Ask how long it typically takes for a claim to be reviewed and settled. Delays can be extremely disruptive when your RV is both your home and your primary means of transportation.

Find out what documentation is required to file a claim. Knowing in advance which photos, receipts, and reports you will need can save valuable time and reduce stress during an emergency.

It is also wise to ask whether the insurer provides a mobile app or online portal for submitting and tracking claims. Digital access makes it easier to stay informed and communicate with adjusters while traveling.

Exploring cost saving opportunities

Insurance premiums can be a significant part of your budget, so it is smart to look for ways to reduce costs without sacrificing essential protection. Ask whether discounts are available for bundling your RV policy with auto, umbrella, or other types of insurance. Many providers offer lower rates when multiple policies are held under the same account.

Safe driving discounts are another option to explore. Inquire whether a clean driving record, completion of safety courses, or installation of security devices can lower your premium.

Discuss deductible options as well. A higher deductible can reduce your monthly payment, but it should only be chosen if you are comfortable paying that amount out of pocket in the event of a claim. For more practical strategies on managing premiums, you can also consult top-tips-for-reducing-full-time-rv-insurance-costs, which explains how policy structure and lifestyle choices can influence overall expenses.

Assessing insurer reputation and support

The reliability of the insurance company is just as important as the coverage itself. Ask about the insurer’s financial stability and credit rating. A financially strong company is more likely to meet its obligations and pay claims promptly, even during widespread disasters.

Customer service quality also deserves careful attention. Look for reviews and satisfaction ratings to understand how the company treats its policyholders. Ask whether twenty four hour support is available, especially for claims and roadside emergencies. For full time RVers, access to help at any hour and in any location can make a major difference.

creating a personal checklist

Before speaking with insurance providers, prepare a simple checklist to guide your conversations and help you compare policies objectively. Your checklist may include the following points.

Verify personal property and liability coverage limits

Confirm exclusions and conditions related to full time living

Review the claims process and required documentation

Ask about discounts, bundling, and deductible options

Research the insurer’s financial strength and customer service reputation

Ensure twenty four hour support and roadside assistance are available

Using this checklist allows you to evaluate each offer based on the same criteria and avoid making decisions based solely on price.

final thoughts

Choosing the right full-time-rv-insurance requires more careful planning than purchasing a standard auto or recreational policy. By asking detailed questions about coverage limits, exclusions, claims handling, cost saving opportunities, and insurer reliability, you can protect both your home and your financial security.

Taking the time to understand your options and compare answers from multiple providers will help you select a policy that truly supports your mobile lifestyle. With the right preparation, you can travel with confidence, knowing your insurance is designed to protect you wherever the road takes you.